Is the USD collapsing?

The USD has weakened in the first half of 2025 - are we witnessing a currency rout?

There has been much commentary about the USD’s weakness and whether this trend will continue. In the first half of 2025 the DXY Dollar Index fell by over 10.7%.

Are we in for more? Lets explore the monetary dynamics below.

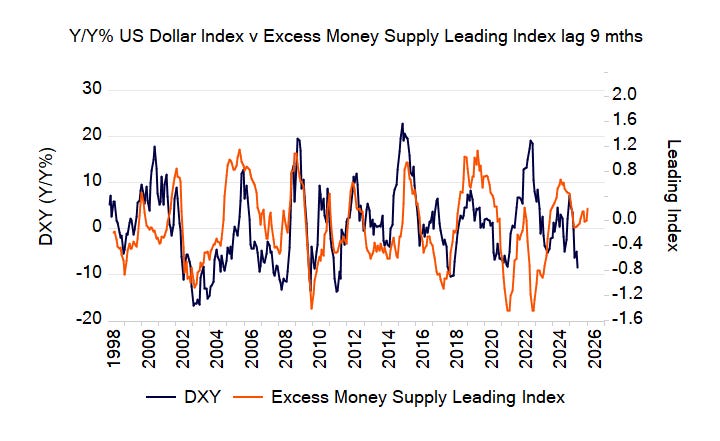

For us, the primary driver of exchange rate fluctuations is the excess money supply growth differential between two countries. Excess money supply growth is defined as the difference between the growth rate of the supply of money and that of the demand for money. The greater the level of excess money growth in one economy compared to another, the more surplus currency there is in that economy and the weaker its exchange rate will be versus the second economy.

For the Dollar Index below we have calculated this differential between major foreign countries and the US.

The excess money differential fell from June last year until June this year, favouring foreign currencies. Moving into the second half of the year the downtrend appears to be bottoming, with a slight uptick emerging.

Does this mean we have seen the end of the USD’s overall weakness?

Note that our target variable here is the momentum of the currency rather than its absolute level. Thus a caveat is that whilst momentum may bottom, this does not necessarily mean that the currency also does in absolute terms, at least not yet.

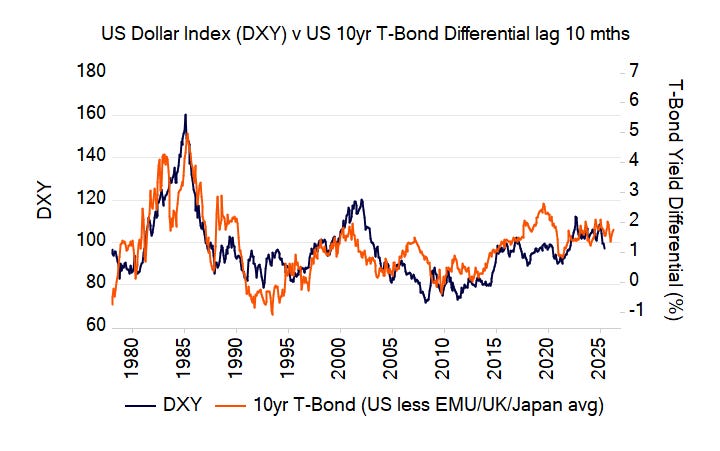

Can interest rate differentials provide any further clarity?

The chart shows that the interest rate differential between the US 10yr T-Bond and those of Germany, Japan and the UK seems to lead the Dollar index itself by around 10 months. No clear downtrend or uptrend, however, seems to be emerging from this perspective.

Thus all we can say is that the downward momentum (yearly rate of change) of DXY could soon abate and reverse. Apocalyptic fears of long term USD decline - or indeed collapse - are not (yet) supported by our analysis.