US job market continues to defy the gloom

Life gets more complicated for those wanting more Fed easings

US nonfarm employment increased by 147,000 in June – above the expected increase of 110,000. The yearly growth rate edged up to 1.2% p.a. in June from 1.1% p.a. in May.

This is in line with our overall analysis of the US economy in general and the US employment market in particular.

Recall our outlook for the ISM Manufacturing PMI:

This is for a very slow improvement in growth over the next year or so.

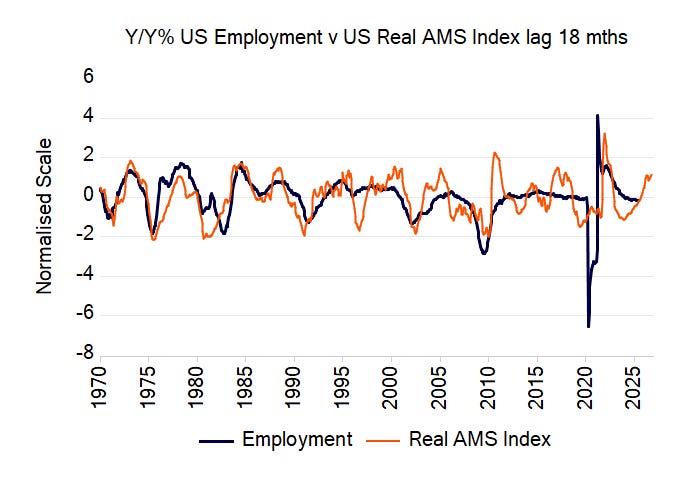

Consistent with this scenario we see the prospects for the job market also getting brighter. Here we use the annual growth rate of our real money supply (real Adjusted Money Supply or real AMS) to gauge the outlook for annual nonfarm job growth, looking out around 18 months:

The employment growth curve is slowly turning upwards, as would be expected using our analysis.

When we look at uneployment we see that the annual rate of change in the unemployment rate is likely to continue to decline.

So, overall, it looks like the monetary drivers will deliver very modest improvement in the empoyment market in the US over the next year or so.

This makes it just that little bit harder to argue for further Fed stimulus via rate cuts.